Sample Commentary Report

SUNDAY, JANUARY 12th, 2026

This week brings us the release of six monthly economic reports along with a periodic Fed report, a couple of Treasury auctions and a large number of Fed speeches. Three of those five monthly releases are labeled very important for the markets. The week begins fairly light with none of the data releases scheduled for tomorrow, but there is something that could affect rates later in the day. We should see the most movement in mortgage pricing the middle days since those are the days with the more influential releases.

While tomorrow doesn’t have any relevant economic data scheduled for release, there is an afternoon event that has the potential to affect rates. The first of this week’s two Treasury auctions that we need to watch is taking place tomorrow. 10-year Treasury Notes are being sold tomorrow, followed by 30-year Bonds Tuesday. Results of each sale will be posted at 1:00 PM ET those days, giving us an indication of investor appetite for long-term securities. Mortgage rates are based on long-term debt, so a strong demand for the securities could contribute to an improvement in bond prices and mortgage rates tomorrow and/or Tuesday afternoon. On the other hand, a lackluster demand may cause an upward revision to rates.

December’s Consumer Price Index (CPI) is the week’s first piece of economic data that we need to be concerned with. It will be released early Tuesday morning and is one of the most important monthly reports because it measures inflationary pressures at the consumer level of the economy. There are two readings in the release, the overall and the core data that excludes more volatile food and energy prices. The overall reading is expected to have risen 0.3% from November and have held at 2.7% year-over-year. More importantly, core data is expected to be up 0.3% for the month and have risen 0.1% annually from November’s 2.6% pace. If this report shows consumer inflation is softer than thought, we should see bonds rally Tuesday morning, pushing mortgage rates noticeably lower. That would also make another Fed rate cut in the near future more of a possibility.

Also scheduled for Tuesday morning is the release of the New Home Sales report that was delayed due to the shutdown. This update will cover sales of newly constructed homes in September and October. It usually carries a weak influence on rates because it tracks only a small portion of all home sales in the U.S., but since this week’s data is now aged, we are not expecting to see its results have any impact on rates. The inflation data will certainly drive mortgage rates Tuesday much more than this report will.

The sister release of the CPI is the Producer Price Index (PPI) that will be posted early Wednesday morning. The PPI tracks inflation at the wholesale level of the economy rather than the consumer level. Also worth noting is that this version is a combination of October and November’s data compared to just December for the CPI. The monthly PPI increases are expected to be similar to the CPI, but the annual readings differ. As with any inflation data, good news for rates would be softer than expected price pressures, making long-term debt, such as mortgage bonds, more attractive to investors.

Wednesday’s second highly important release will be November’s Retail Sales data, also at 8:30 AM ET. It measures consumer spending, which is watched closely because this category makes up over two-thirds of the U.S. economy. Current forecasts show a 0.4% rise in overall sales, indicating economic strength. Analysts are also expecting to see a 0.3% rise in sales if more volatile and costly auto transactions are excluded. Stronger than expected sales would be considered bad news for bonds and likely lead to an increase in mortgage pricing. Favorable news for rates would be weaker numbers since slowing consumer spending should limit economic growth.

The National Association of Realtors will give us the most relevant housing sector report at 10:00 AM ET Wednesday. Their December Existing Home Sales report offers insight into the housing sector via home resale statistics. Market participants are expecting to see a small increase in sales last month, indicating modest strength in the sector due to lower mortgage rates. Because housing gains can fuel strength in the broader economy, mortgage rates should move slightly lower if sales are weaker than predicted- assuming the earlier sales data doesn’t show a significant surprise.

Wednesday also has an afternoon event that may affect the markets. The Federal Reserve’s Beige Book report will be posted at 2:00 PM ET. This report is named simply after the color of its cover and details economic conditions throughout the U.S. by Fed region through the eyes of their business contacts. Since the Fed relies heavily on this info during their FOMC meetings, its results can have an impact on the financial markets and mortgage rates if it reveals any surprises. Of particular interest is information regarding inflation and employment strength. If there is a reaction to the report, it will come during mid-afternoon trading Wednesday.

This week’s only other relevant monthly report is December’s Industrial Production data at 9:15 AM ET Friday. It helps us measure manufacturing growth by tracking output at U.S. factories, mines and utilities. We don’t usually see a strong reaction to this report’s results and that should be no different this month. Forecasts have production up at a 0.2% rate. Unless there is a huge difference between expectations and forecasts, we shouldn’t see mortgage rates react to the report.

There are also a large number of Fed-member speeches this week that have the potential to affect the markets and possibly mortgage rates. Most of them don’t appear to be too concerning since they have mundane topics. However, one particular speech scheduled Wednesday morning and another two happening Friday stand out as most likely to influence rates because they appear to related to monetary policy and/or the outlook of the U.S. economy.

Overall, Tuesday is the most important day for rates due to the influence the CPI has on the markets, but we may also see a big move Wednesday with so much information coming, including the key consumer spending report. The calmest day should be Friday unless something unexpected happens. With a packed calendar of relevant events this week, it would be prudent to keep an eye on the markets if still floating an interest rate and closing in the near future because we are expecting to see quite a bit of volatility, especially the middle days.

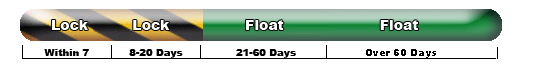

If I were considering financing/refinancing a home, I would…. Lock if my closing was taking place within 7 days… Lock if my closing was taking place between 8 and 20 days… Float if my closing was taking place between 21 and 60 days… Float if my closing was taking place over 60 days from now…

SEE WHAT WE CAN OFFER BY TAKING ADVANTAGE OF OUR LIMITED TIME FREE TRIAL

Our Service Helps Allow Our Clients to Be More Efficient With Their Time

Less fielding of phone calls or replying to emails about “what mortgage rates did today”

Our Daily Mortgage Commentary translates complex economic into laymen’s terms

This allows most borrowers, Realtors and mortgage professionals to understand what is happening with residential mortgage rates on a daily basis.

Completely unbiased, professional opinion about locking or floating an interest rate.

We also go out on a limb that many of our peers avoid. We give you short-term and long-term opinions of which direction interest rates may be heading.

Explore our subscription options

(813) 961-9223 / info@mortgagecommentary.com

Mortgage Commentary Services, Copyright 2026 ©